In today’s rapidly evolving financial landscape, AI is no longer just an option—it’s a necessity. Financial institutions are increasingly adopting AI-driven solutions to tackle some of their most pressing challenges, from fraud detection to compliance management. In fact, companies that integrate AI into their operations are already seeing improvements in decision-making speed, cost reduction, and operational efficiency. But how can financial firms maximize these benefits and stay ahead in a competitive market?

Drawing on decades of experience in financial leadership and advanced AI solutions, I’ve witnessed firsthand how AI can transform processes, reduce risks, and drive growth across the financial services sector. While the competition is fierce, the opportunities AI provides are too valuable to ignore.

Tackling Fraud Detection with AI

Fraud detection has always been one of the most significant challenges for financial institutions. As fraudsters evolve their tactics, the financial services sector must keep pace by adopting advanced tools to identify and combat these risks. Traditional methods—relying heavily on manual audits and checks—are no longer enough.

AI-driven fraud detection tools provide a powerful solution. By analyzing large datasets in real-time, AI can identify anomalies and patterns that are often missed by human teams. Instead of reacting to fraudulent activity after it occurs, AI allows institutions to become proactive, flagging suspicious behavior before significant damage is done. For example, my patented AI-based fraud detection system has shown how real-time data analysis can prevent fraud more efficiently than ever before. This innovation has received the EU Seal of Excellence.

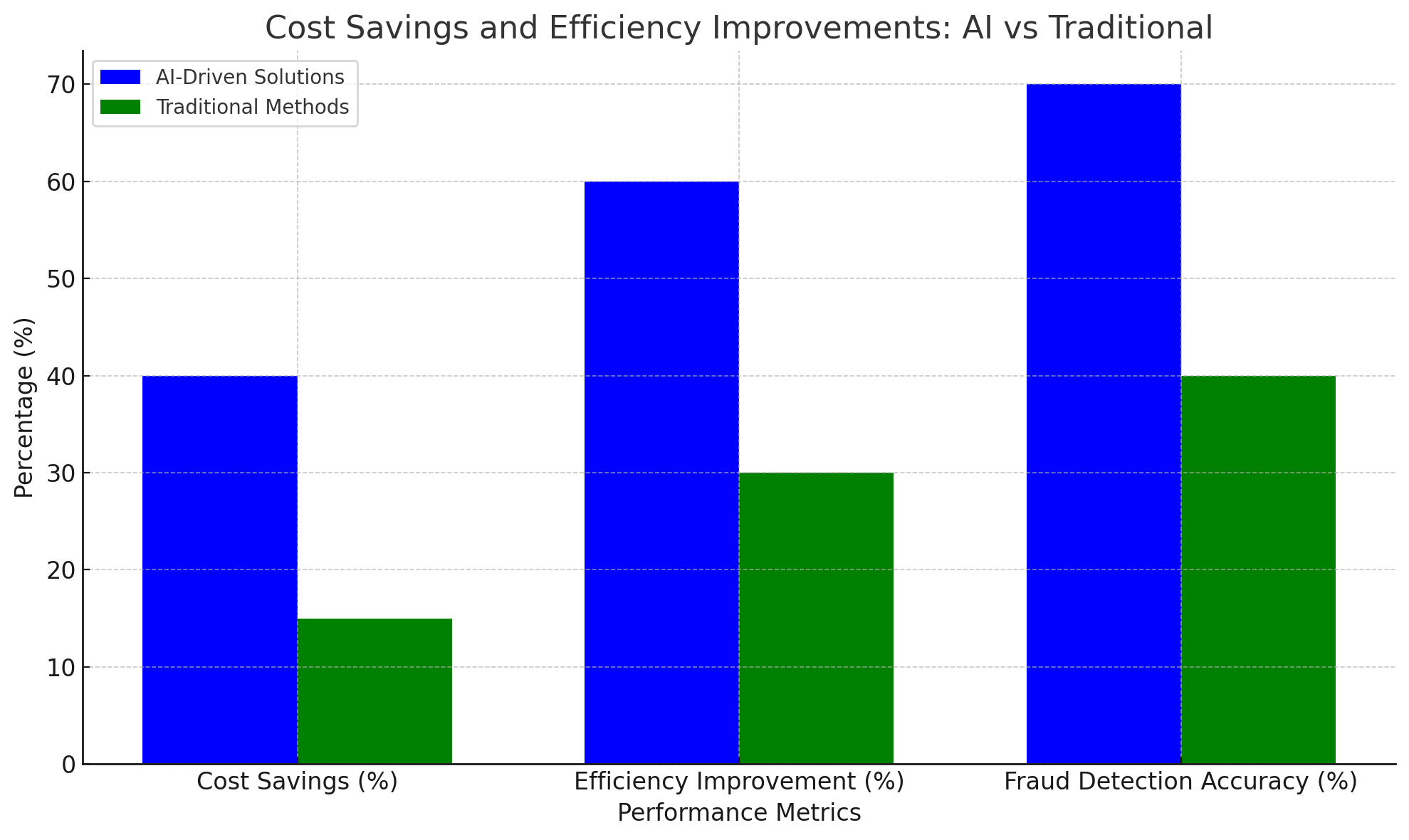

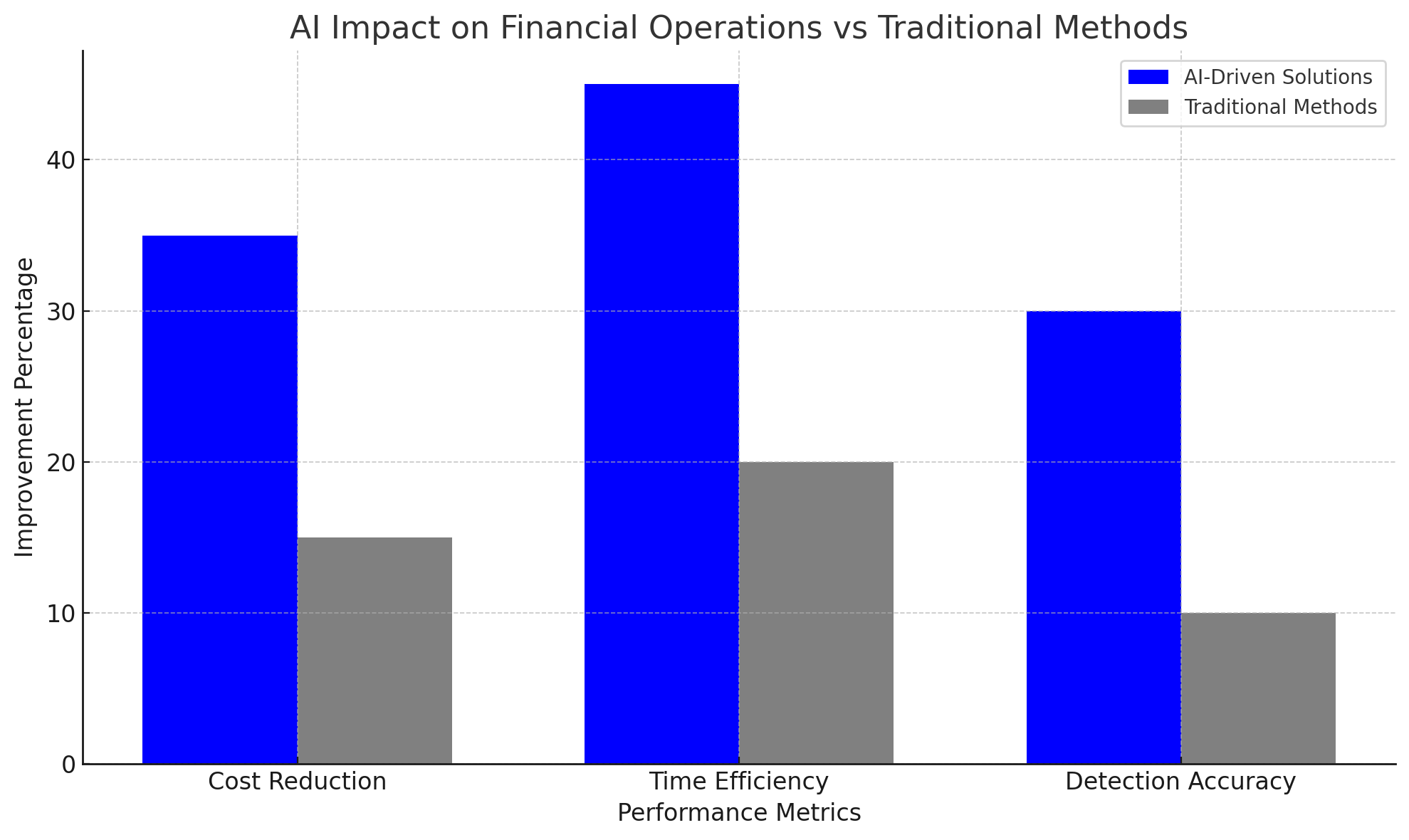

In fact, Deloitte (Fraud and Financial Crime in the Digital Age) reports that AI-driven fraud detection can improve accuracy by up to 30% while reducing compliance-related costs by 25-35%. With AI, financial institutions can create a safer, more secure environment for their clients while reducing the operational burden on their teams.

Enhancing Compliance with AI Solutions

The growing complexity of financial regulations is another area where AI can make a significant impact. Compliance-related tasks are often resource-intensive and prone to human error, which can lead to costly penalties and reputational damage.

AI-based compliance tools automate much of the regulatory reporting and document management processes, freeing up teams to focus on more strategic tasks. By using AI to monitor transactions, track regulatory changes, and ensure compliance, financial institutions can reduce the risk of violations and improve overall efficiency.

AI is already reducing compliance costs by automating tedious manual processes. Institutions that adopt AI-powered compliance solutions can cut costs by up to 35%, according to PwC (AI and Compliance: Driving Efficiency in Financial Services). With these savings, financial institutions can reinvest in their core activities, driving long-term growth and stability.

AI-Enhanced Decision-Making: Predictive Analytics

Beyond fraud detection and compliance, AI is also transforming decision-making across financial services. Predictive analytics, powered by AI, offers institutions the ability to forecast market trends, assess risks, and optimize investment strategies based on real-time data.

Incorporating AI into decision-making processes helps financial institutions identify opportunities and threats much faster than traditional models. By analyzing vast amounts of historical data, AI can provide insights that allow decision-makers to act with greater confidence and accuracy. In volatile markets, this agility is critical.

Companies using AI for predictive analytics are outperforming those that don’t. By leveraging AI for smarter, data-driven decisions, financial institutions can mitigate risks, improve portfolio performance, and stay competitive.

AI as a Competitive Advantage in Financial Services

AI is no longer just a buzzword in the financial industry—it’s becoming the foundation of operational efficiency and strategic decision-making. Firms that integrate AI solutions are already enjoying improved fraud detection, streamlined compliance, and enhanced decision-making capabilities.

However, the competition is heating up. Institutions that lag in adopting AI risk falling behind their competitors. AI allows organizations to reduce operational costs, mitigate risks, and offer more personalized services to their clients, ultimately enhancing customer satisfaction and retention. The World Economic Forum estimates that AI adoption could lead to a 20% increase in financial sector productivity by 2025.

Given the immense potential of AI, it’s crucial for financial institutions to act now. The benefits are clear: lower costs, higher accuracy, and better decision-making.

Conclusion

The financial services sector is at a critical juncture. AI is set to revolutionize operations, from fraud detection and compliance to decision-making and beyond. Financial institutions that embrace AI are positioning themselves to thrive in an increasingly competitive market.

Through my extensive work in financial services, fraud detection, and AI-driven solutions, I’ve seen firsthand how AI can solve some of the most complex problems facing the industry today. Institutions must not only recognize the potential of AI but act quickly to implement these innovations—before their competitors do.

My other article about Leadership: How AI is Transforming Business Decision-Making (jameslarsson.pro) is also complementing the above finanacial article